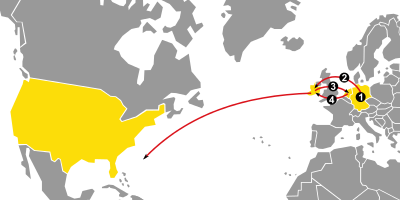

Governments around the world have grappled with the challenge of sufficiently taxing international companies – particularly peripatetic tech giants – which aggressively pursue policies of (perfectly legal) tax avoidance. One of the main reasons that so many Silicon Valley icons decide to base their European operations in Dublin (including Google and Apple) is due to the low rate of corporation tax in Ireland (compared to most other EU countries) – and the ability to further minimise their taxes by taking advantage of tricks such as profit shifting. The G7 have been discussing the best way to implement a fair method of international taxation – but, in the meantime, France has decided to go ahead and impose its own levy, to the consternation of the US.

The French Senate approved a new law in July 2019 which levies a 3 per cent tax on digital services gross revenue (as opposed to profits) made in France by companies with total worldwide revenues of more than €750 million – of which at least €25 million is generated in France. Dubbed the GAFA tax (after Google, Apple, Facebook, Amazon), it applies retroactively from 1 January 2019 and is estimated to affect around 30 companies.

Donald Trump initially ordered an investigation into the new tax, raising fears that this could spark a trade war. But following G7 talks, Emmanuel Macron announced that an international agreement was finally in sight – “On the digital tax we have reached a deal to get beyond the difficulties we had between us” – and that the GAFA tax will be scrapped once this has been implemented.

The UK has also announced plans to introduce its own digital services tax in 2020 which would apply a 2 per cent levy on the revenues of search engines, social media platforms and online marketplaces. But whether or not this will actually make it onto the statute books before the aforementioned international tax is implemented – especially in light of legislative delays caused by Brexit – stands to be seen.

Image: Double Irish with a Dutch sandwich, Wikimedia commons